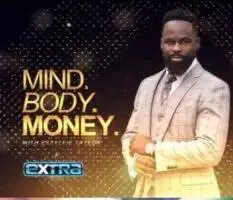

As the country’s leading African-American financial advisor and star of the new TV series “Mind. Body. Money,” Eszylfie Taylor shares his savvy New Year’s Financial Resolutions in order to start the year fresh in 2023. 2023 New Year’s Financial Topics that Eszylfie can go into detail about include: 1. Revisit Your Household Budget 2. Check Your Emergency…

Read MoreSharita Humphrey is a Self spokesperson, former customer, and award-winning Certified Financial Education Instructor who uses her past bought up with poverty and struggle to change lives and teach people, especially families, and youths, how there are always solutions for those who seek them and Never give up! She made her dreams come true now…

Read MoreDo you feel that life is getting stagnant? That your potential is being wasted? Perhaps you cannot find what you are looking for. Career Coach Aaron Carter has over 20 years of experience teaching people to become their best selves through self-honesty, using their opportunities wisely, and taking responsibility for their life! We discuss the…

Read More(Photo: Pexels) O Happy Day! Bitcoin, the market driver, the juggernaut, the oldest coin in the crypto space, which usually determines whether the entire market rises or falls, has been rising appreciably this past week. Stocks have been successful as well, and while I know we are all tired of crypto only rising when stocks…

Read MorePhoto by Kindel Media: https://www.pexels.com/photo/couple-standing-in-front-of-their-house-7579047/ The Nassau County Legislature voted unanimously to clear the way for correcting 842 erroneous school tax bills that caused impacted homeowners to be overcharged by more than $1.5 million. First exposed by the Minority Caucus on Oct. 12, the error was caused by a failure of the Department of Assessment…

Read MoreThe Internet’s most Googled NFT question is “What is an NFT?”, new research has revealed. The study by CoinGecko, the world’s largest independent cryptocurrency site, analyzed thousands of NFT-related search terms to see which is Googled the most, with the most common phrase questioning what an NFT is. The data indicated that the question is Googled on average…

Read MoreNew York State’s largest African American Chamber the Long Island African American Chamber of Commerce, Inc. (LIAACC) encourages Corporations to Support Diversity during National Black Business Month. Corporations who support chambers of commerce such as the Long Island African American Commerce can set a great example for all companies to follow in leveling the playing field for blacks…

Read More- « Previous

- 1

- 2